Website calculators are interactive tools that help users perform specific calculations such as pricing estimates, loan repayments, budgeting, or investment returns. They are commonly used on business, finance, e-сommerce, and service-based websites to deliver instant results and personalized insights.

Selecting the best website calculator ensures your users get accurate, fast, and relevant information while improving engagement and conversions. Whether you’re offering a simple quote form or a detailed financial planner, the right calculator can significantly elevate user experience.

- Boosts user interaction. Calculators encourage visitors to engage with your content by inputting personal or financial data to receive tailored results.

- Delivers practical value. From mortgage estimates to ROI analysis, calculators provide useful answers that help users make informed decisions.

- Enhances conversion potential. Businesses use calculators to guide visitors toward signups, purchases, or consultations by offering instant feedback and pricing estimates.

- Improves time spent on page. Interactive features like calculators increase dwell time, which supports SEO and lowers bounce rates.

- Supports personalization. By adapting results to each user’s input, calculators make the experience feel custom-built and relevant.

Below, we’ll compare the best website calculators available today — covering everything from pricing and budgeting to financial planning and digital valuation.

Top Website Calculators Compared

This table gives you a side-by-side comparison of the best website calculators available today. It highlights pricing, use cases, customization flexibility, and more — so you can find the one that fits your needs.

| Provider | Best For | Pricing | Embeddable | Customization Level | Calculator Types |

|---|---|---|---|---|---|

| Elfsight | Service businesses, e-commerce, SaaS | Free & Paid Plans | Yes | High (drag-and-drop editor) | Pricing, ROI, Cost Estimators |

| Bankrate | Real estate, mortgage, lending | Free | No | Low | Mortgage, Loan, Refinance |

| NerdWallet | Personal finance, budgeting | Free | No | Low | Budget, Loan, Retirement |

| Calculator.net | General use, all-purpose | Free | No | Low | Finance, Health, Business |

| SmartAsset | Tax prep, mortgage, investment | Free | No | Low | Taxes, Mortgage, Retirement |

| Ramsey Solutions | Faith-based budgeting, debt payoff | Free | No | Low | Budget, Retirement, Debt |

| Investopedia | Financial education, investing | Free | No | Low | Compound Interest, ROI, Tax |

| Empire Flippers | Website owners, business sellers | Free | No | Low | Website Valuation |

Now, let’s explore each provider in more detail to help you decide which calculator is the best match for your website and goals.

Elfsight

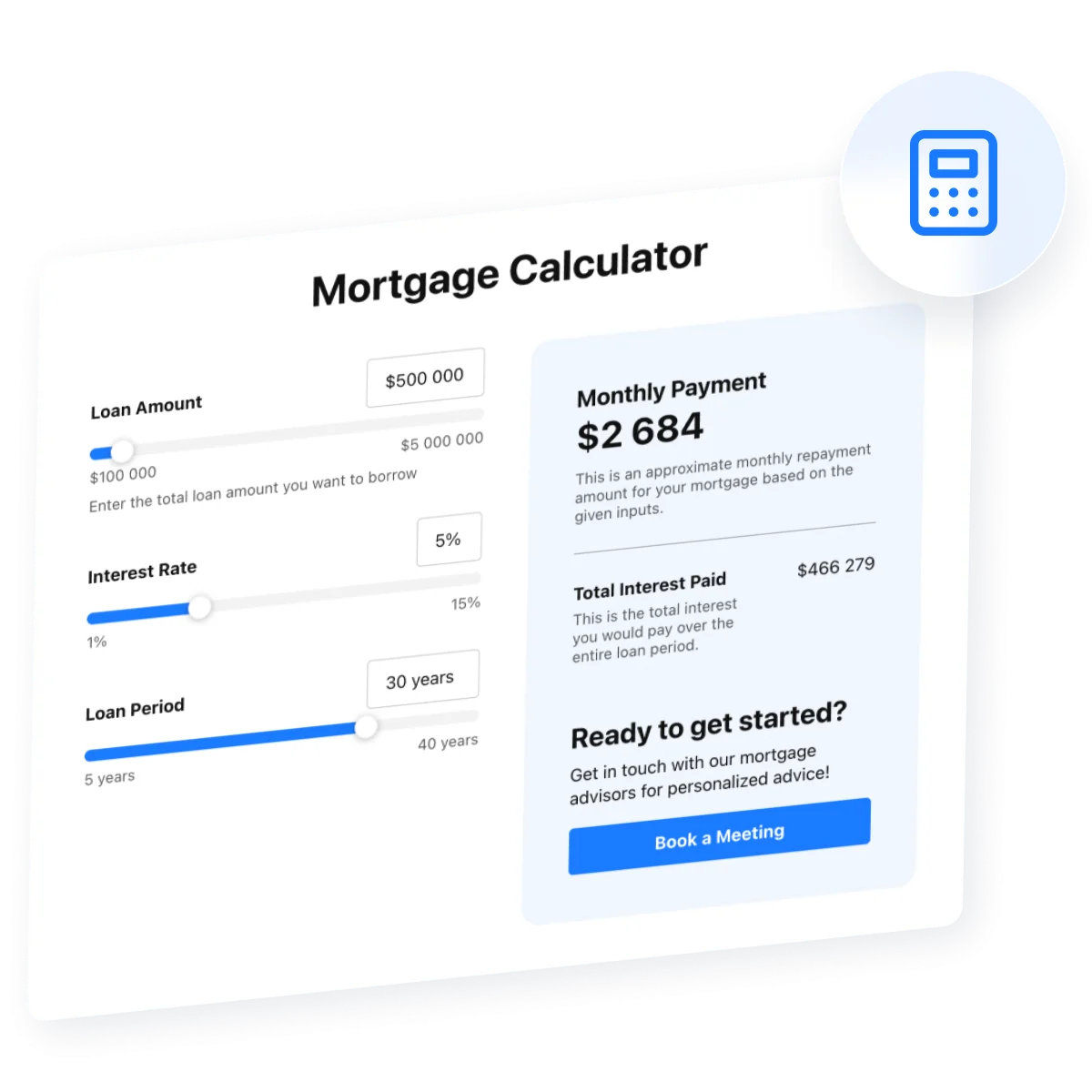

Designed for businesses that want to offer instant calculations to their users, the Elfsight Calculator widget lets you create interactive forms tailored to your needs. It works perfectly for e-commerce, service providers, SaaS companies, and anyone who wants to simplify decision-making on their website.

This widget provides a frictionless way to deliver value and collect leads without overwhelming users. Whether you’re offering price estimates, financial projections, or budget breakdowns, the Elfsight Calculator ensures your visitors get the answers they need in seconds — boosting trust and engagement in the process.

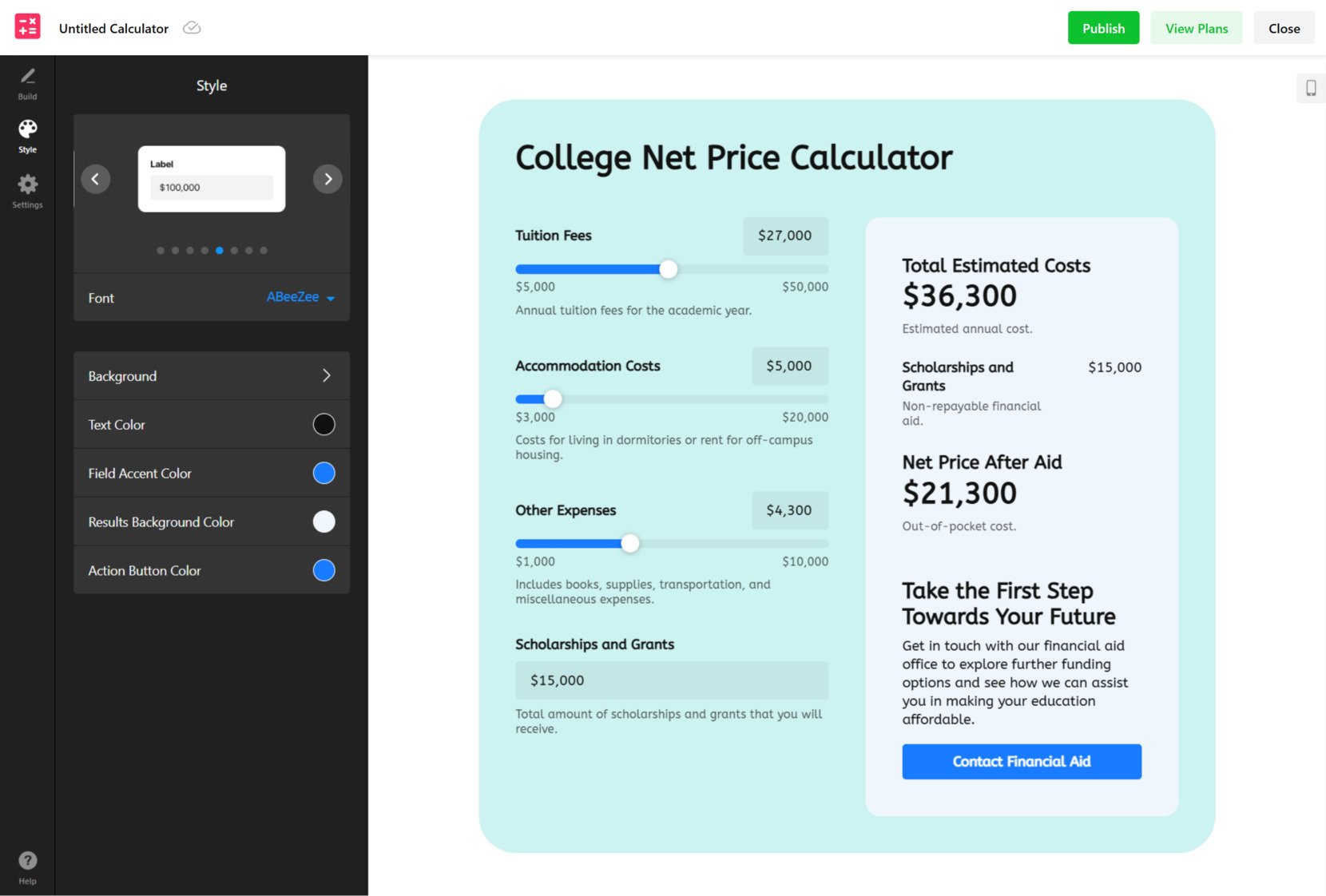

How it works: The widget is fully no-code and built with an intuitive drag-and-drop editor. You can create a custom calculator for your website with fields, formulas, and styling options — all without technical knowledge. Once ready, it can be embedded in any platform via iframe or HTML snippet and will display responsively on all devices.

- Drag-and-drop editor. Build calculators visually with a code-free setup.

- Custom formulas. Set up your own logic for real-time result generation.

- Flexible layout options. Adjust design, colors, spacing, and input styles.

- Conditional logic. Show or hide fields based on user choices for more dynamic experiences.

- Pre-made templates. Start quickly with templates for pricing, finance, and service estimates.

- Responsive design. Optimized to work seamlessly on desktop and mobile.

- Embed anywhere. Easily insert the widget on any website using copy-paste code.

Pricing: A free plan is available with basic functionality. Paid plans with advanced features start from just $5/month.

Ideal for: Small and medium businesses, service-based websites, eCommerce platforms, consultants, and marketers who need interactive pricing or quote tools.

Build your custom calculator now and boost your website’s engagement instantly!

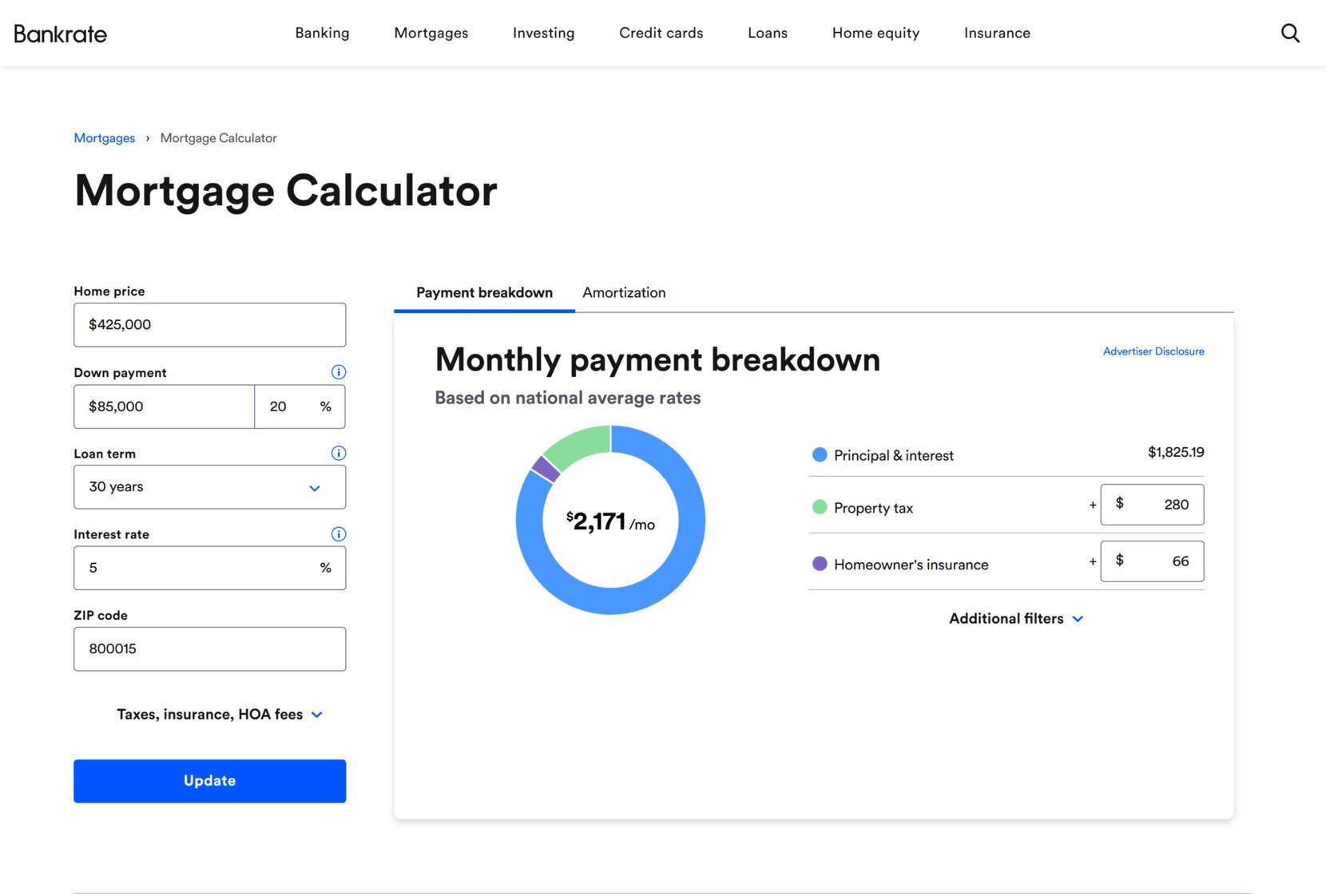

Bankrate

Bankrate’s calculators are ideal for individuals looking to evaluate key financial decisions — from buying a home to managing credit card debt. The tools are designed to deliver quick, informative results without requiring account creation or personal data input. They’re especially trusted by users in banking, lending, and personal finance sectors.

Each calculator is presented in a user-friendly layout with fields for common variables and results that update in real time. Though not embeddable on external websites, the tools are frequently referenced by financial publishers and recommended by advisors due to their accuracy and clarity.

How it works: Users visit a calculator page, input the necessary financial details (e.g., loan amount, interest rate, term), and receive real-time estimates based on standard formulas. No signup is required. All calculators are hosted on Bankrate’s platform and are accessible via desktop and mobile browsers.

- Mortgage calculators. Evaluate monthly payments, interest breakdowns, and affordability.

- Loan comparison tools. Analyze the total cost of loans based on rates and terms.

- Credit card payoff calculator. Estimate how long it will take to eliminate credit debt with fixed payments.

- Refinancing calculator. Determine the potential benefits of mortgage or loan refinancing.

- Home affordability calculator. Understand what price range fits your income and debt profile.

- Debt-to-income ratio checker. Assess financial health for loan qualification.

Pricing: All calculators are available for free and supported by advertising and affiliate content.

Ideal for: Consumers researching home loans, refinancing options, credit management, or general financial planning — particularly in banking or real estate contexts.

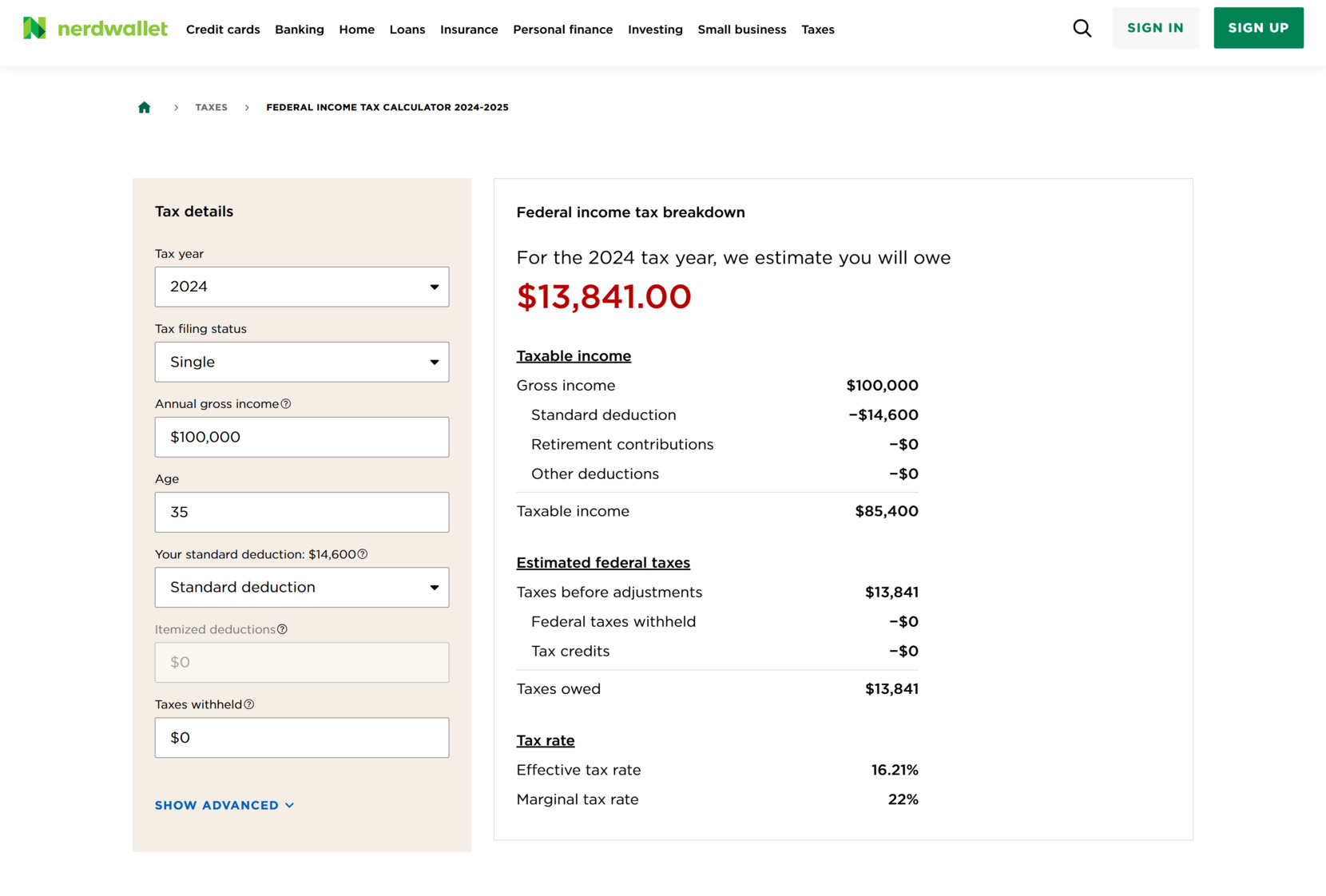

NerdWallet

NerdWallet’s calculators are tailored to help everyday users make confident financial decisions. Each tool is designed to break down complex financial concepts and provide actionable insights in seconds. The calculators are organized into clear categories and supported by expert-written guides for deeper understanding.

Every calculator on the platform runs directly within NerdWallet’s educational pages, offering built-in context and suggestions. While the tools are not embeddable or customizable, they are user-friendly, fast-loading, and optimized for mobile. They’re best suited for individuals who want trustworthy numbers for budgeting, investing, or credit management.

How it works: Users choose a calculator type and enter basic details like income, expenses, interest rates, or investment amounts. The tool then displays estimates with explanatory notes or visuals. No login or data storage is required, and the calculators are integrated into articles for added clarity.

- Credit card calculators. Help users evaluate interest costs, payoff timelines, and rewards value.

- Banking calculators. Compare savings accounts, interest earnings, and checking account fees.

- Investing and retirement calculators. Project potential returns, savings growth, and retirement readiness.

- Tax calculators. Estimate federal income tax obligations and refunds based on income and deductions.

Pricing: All calculators are free and openly accessible; revenue is generated through affiliate links and sponsored content.

Ideal for: Consumers exploring credit cards, retirement savings, banking products, or tax planning — especially those seeking a beginner-friendly, content-rich experience.

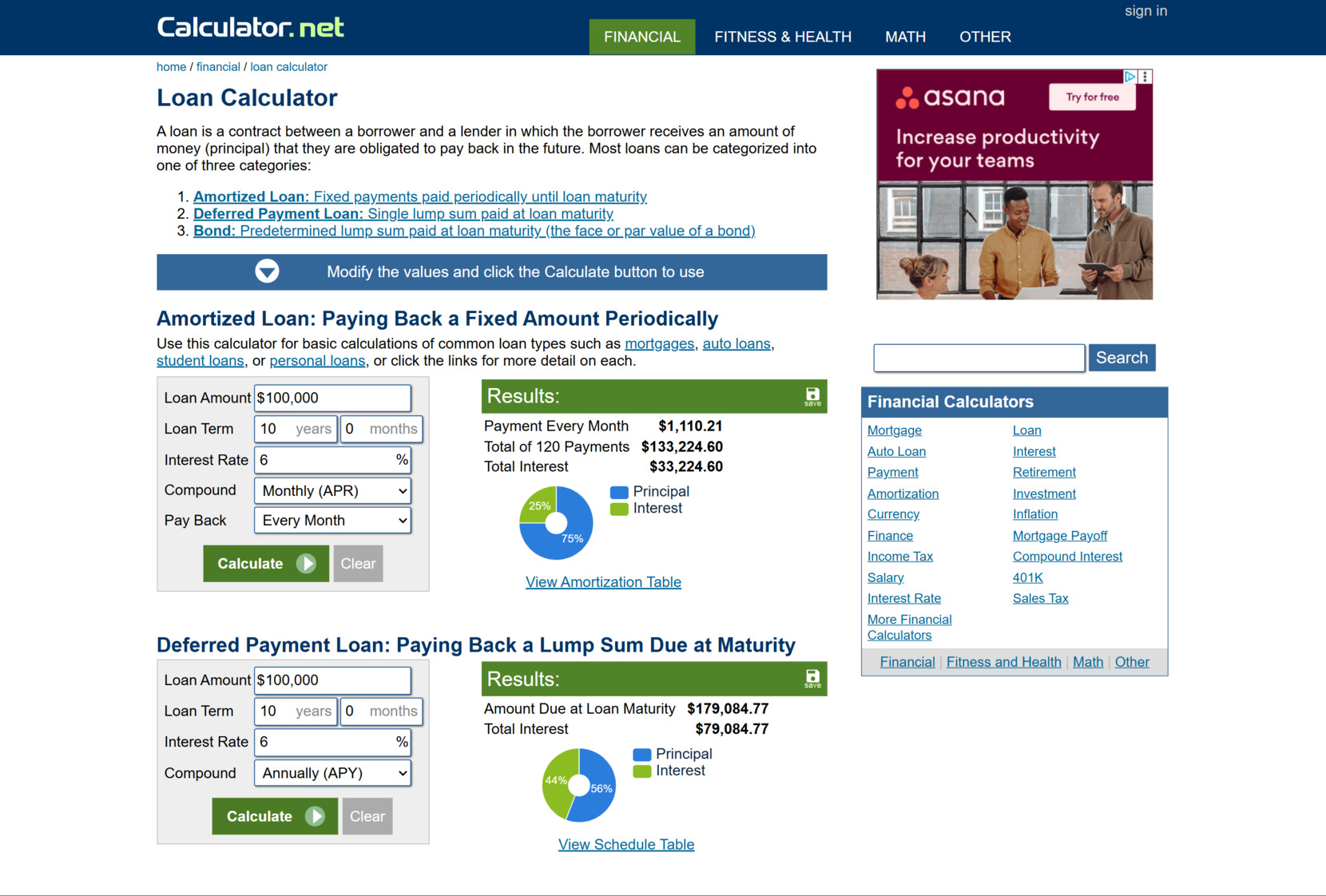

Calculator.net

Calculator.net provides one of the most diverse and complete libraries of web-based calculators available today. Its tools are designed to serve a wide range of users — from students and educators to business owners and financial planners — offering fast and accurate answers to everyday and professional questions.

The platform is entirely browser-based and free to use, with each calculator hosted on a dedicated page. It does not offer embedding or customization, but its wide coverage makes it a reliable reference for almost any calculation need. The interface is simple and clean, focusing entirely on usability and fast results.

How it works: Users browse through categories or search directly for a specific calculator. Once on a calculator page, they input values into a structured form, and results are displayed instantly. Most calculators also include brief explanations or formulas used to provide transparency.

- Financial calculators. Tools for loan amortization, interest, savings, budgeting, and more.

- Health calculators. Includes BMI, calorie, pregnancy, and heart rate calculators.

- Math and conversion tools. Offers everything from algebra calculators to unit converters and geometric functions.

- Business calculators. Useful for break-even analysis, profit margin, inventory turnover, and pricing models.

- Time and date tools. Date calculators, countdowns, and age computations.

Pricing: All calculators are free to use and accessible without registration.

Ideal for: Anyone looking for a fast, accurate, and comprehensive source of web-based calculators — including students, teachers, general users, and professionals.

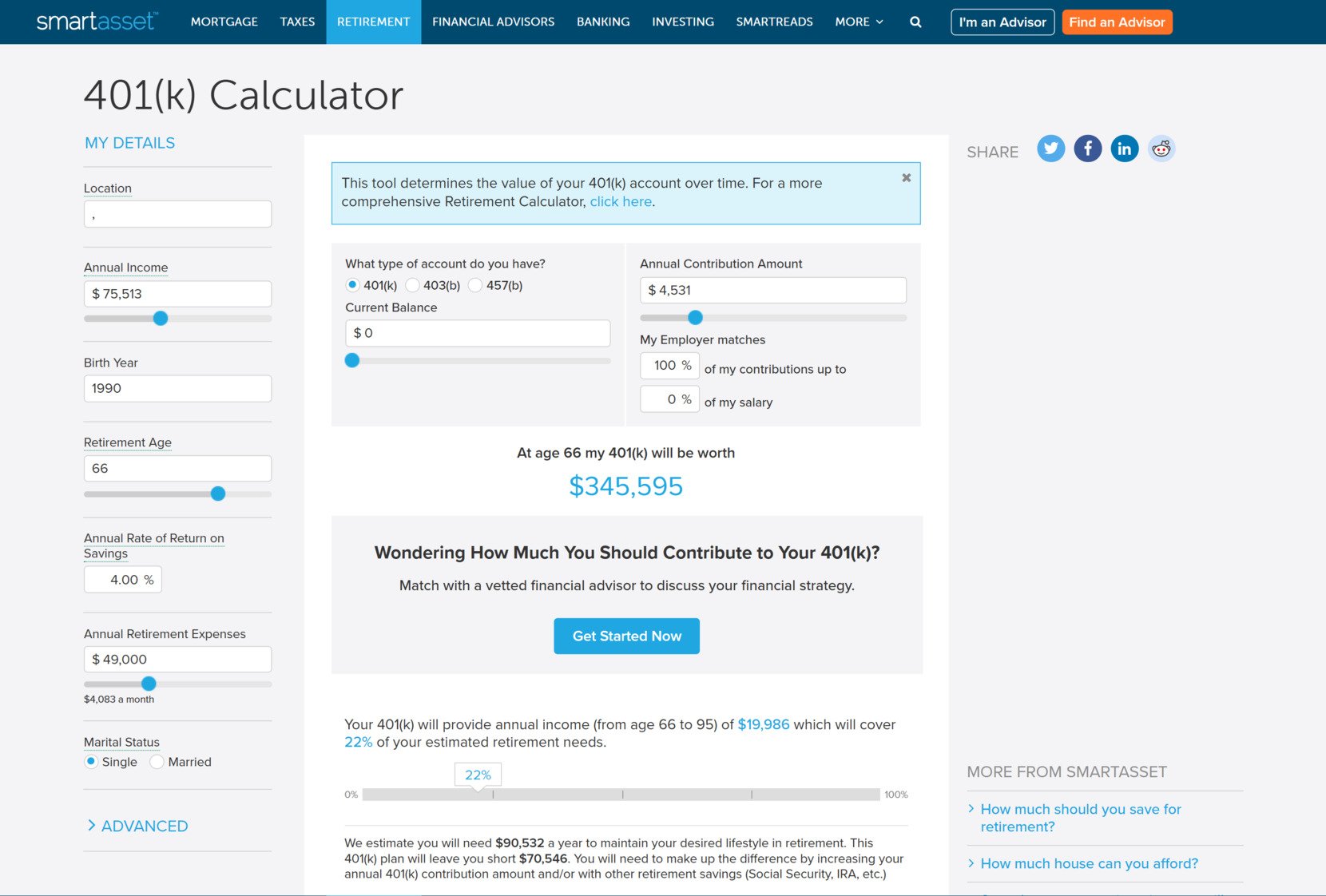

SmartAsset

SmartAsset’s calculators are built to deliver detailed insights for key financial decisions. They help users evaluate investment strategies, estimate retirement income, calculate tax burdens, and understand mortgage affordability. Each tool is backed by current data and integrates seamlessly with financial content to ensure users make informed, confident choices.

These calculators are web-based, fast, and user-friendly, though they are not embeddable on external websites. What sets SmartAsset apart is the depth and specificity of its tools, which often include location-based tax and housing variables, making them more accurate for personalized planning. Many calculators also offer follow-up steps, such as connecting users with vetted financial advisors.

How it works: Users enter key data like income, location, savings, or loan terms. The calculators then generate visual results and breakdowns with contextual explanations. Some tools also prompt users to connect with financial professionals for tailored advice.

- Tax calculator. Estimates federal, state, and local taxes based on income and filing status.

- Retirement calculator. Projects future savings and whether they align with retirement goals.

- 401(k) calculator. Calculates growth based on contribution rate, employer match, and investment return.

- Mortgage calculator. Evaluates monthly payments and interest over the loan term.

- Investment return calculator. Helps forecast earnings based on compounding returns and portfolio performance.

Pricing: All tools are free to use and monetized through lead generation partnerships with financial service providers.

Ideal for: Users seeking reliable, data-driven tools for long-term financial planning — especially those preparing for retirement, managing taxes, or evaluating large investments.

Ramsey Solutions

The platform provides straightforward tools that align with the “Provident Living” approach — promoting financial responsibility, debt freedom, and intentional saving. These calculators are designed for clarity and action, helping users understand how to manage money with a long-term, goal-oriented mindset. They fit well into personal budgeting plans and financial wellness programs.

All tools are hosted on the Ramsey Solutions website, with clean layouts and no clutter. While they can’t be embedded on other platforms, they serve as fast and motivational aids for users pursuing financial independence. The calculators are paired with educational content rooted in the brand’s debt-free philosophy.

How it works: Each calculator prompts users to input basic financial data such as income, expenses, savings, or retirement contributions. Results are shown instantly, along with simple explanations and suggestions tied to Ramsey’s principles. No account is required to access the tools.

- Budget calculator. Helps users allocate income into key categories based on the zero-based budgeting method.

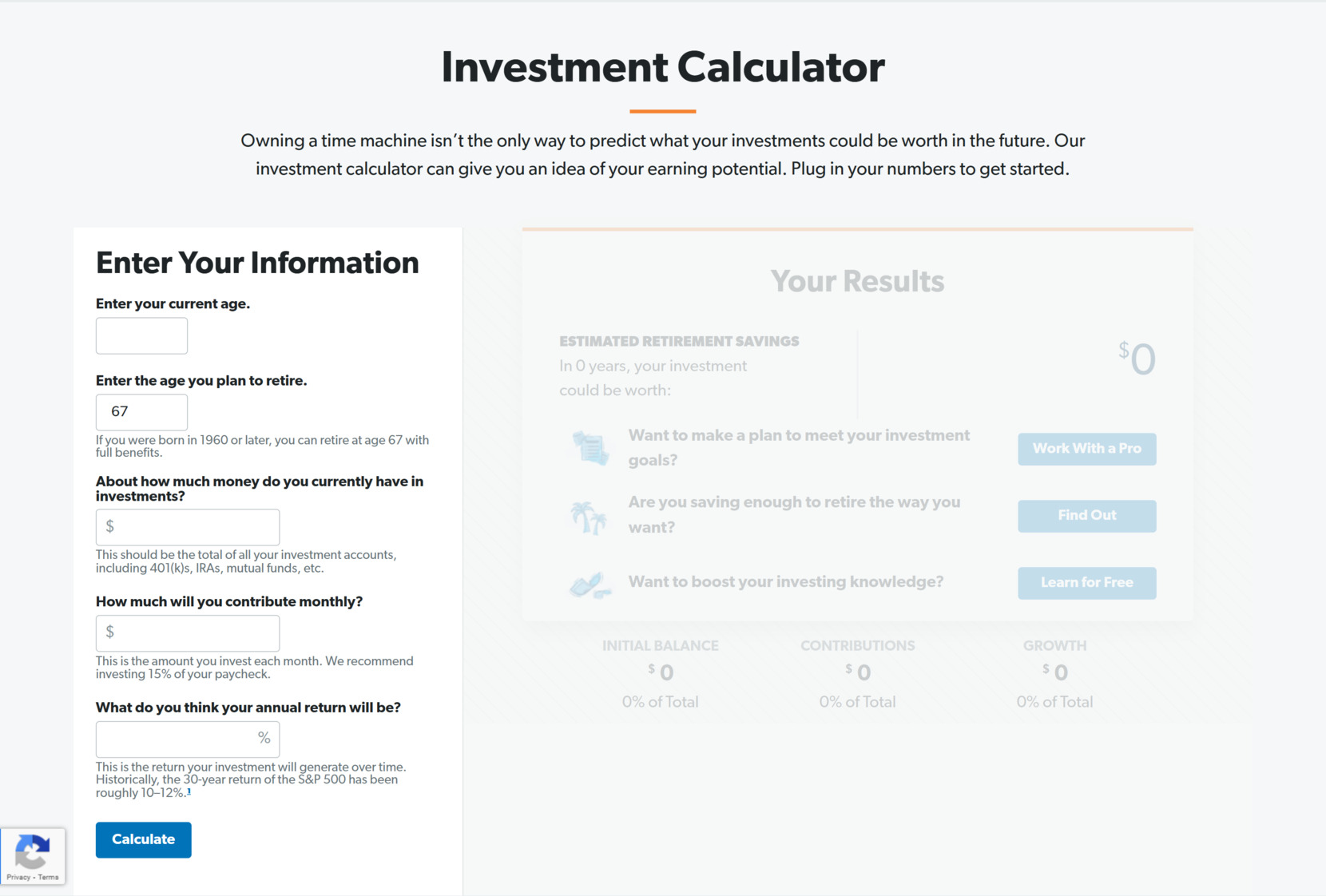

- Retirement calculator. Projects retirement savings based on age, current contributions, and expected growth.

- Investment calculator. Estimates future portfolio value using basic compound interest projections.

- Mortgage calculator. Calculates total payments over time based on fixed-rate mortgages.

- Debt snowball calculator. Shows how quickly debt can be paid off using Ramsey’s recommended strategy.

Pricing: All tools are free to use and supported through Ramsey’s financial education ecosystem.

Ideal for: Individuals and families focused on debt elimination, budgeting, and saving with a values-based approach to money management.

Investopedia

The calculators available on Investopedia are intended to support learning through hands-on exploration of key financial principles. They are frequently used by students, investors, and professionals to simulate investment outcomes, compare interest models, and analyze long-term financial projections. Each tool is embedded within an educational article for deeper understanding.

While limited in number, these calculators focus on critical topics such as return on investment, retirement planning, and loan analysis. The tools are simple, browser-based, and best used as learning aids rather than full-featured financial planners. Their integration into Investopedia’s resource-rich environment makes them especially useful for self-directed education.

How it works: Users enter core financial variables — such as initial investment, interest rate, loan term, or monthly contributions — into a structured form. Calculations are processed instantly, with outputs displayed in charts or summaries, often accompanied by tips or links to related financial concepts.

- ROI calculator. Measures return on investment based on cost and gain to evaluate profitability.

- Compound interest calculator. Projects how an investment grows over time with compounding.

- Loan calculator. Helps users understand total loan cost and monthly payment structure.

- Retirement calculator. Estimates how current savings and future contributions align with retirement goals.

- Debt ratio calculator. Assesses financial risk by comparing debt to income levels.

Pricing: All calculators are free and ad-supported within Investopedia’s content ecosystem.

Ideal for: Students, self-learners, or finance professionals looking to visualize concepts like investment returns, debt ratios, and long-term savings projections.

Empire Flippers

This tool is tailored for entrepreneurs looking to sell, buy, or evaluate an online business. The calculator uses real performance metrics to generate a valuation based on current market trends and comparable sales data. It’s an essential resource for anyone interested in the business of flipping or investing in digital properties.

Unlike general-purpose financial calculators, Empire Flippers’ valuation tool focuses on revenue-generating websites. It considers data like monthly profit, traffic stability, monetization methods, and niche performance to deliver an estimated sale price. The platform also allows users to take the next step by connecting with their brokerage services.

How it works: Users fill out a short form with details such as average monthly net profit, traffic trends, monetization strategy, and business age. The tool instantly calculates an estimated valuation range based on comparable listings from their marketplace and current market multipliers.

- Profit-based valuation. Uses average monthly net profit as the foundation for value estimation.

- Industry-specific insights. Considers business model, niche, and platform type in its algorithm.

- Data-driven multipliers. Applies current market trends to generate a competitive valuation.

- Lead capture feature. Option to submit details and get direct consultation from Empire Flippers’ team.

- Instant estimate. Delivers a valuation range without any login or waiting period.

Pricing: The valuation calculator is completely free and functions as part of Empire Flippers’ lead generation and vetting process.

Ideal for: Online business owners, digital entrepreneurs, and investors evaluating the value of their websites before listing or acquisition.

Choosing the Right Website Calculator

Choosing the best website calculator depends on your business goals, technical setup, and the kind of financial utility you want to offer visitors. From simple price estimators to professional-grade financial tools, the right solution should match your website’s purpose, enhance user engagement, and be easy to manage long term.

For businesses that need full design control

If you want to build and embed calculators that match your branding and workflows, choose a builder like Elfsight. These tools offer drag-and-drop editors, customizable logic, and no-code setup, making them ideal for businesses that prioritize visual integration and interactivity.

For those offering detailed financial guidance

Platforms like SmartAsset and NerdWallet are better suited for users who want to provide accurate, context-rich financial estimators. These tools help users make informed decisions around taxes, investments, or credit — even though they are not embeddable.

For digital product valuation and ROI analysis

To estimate the value of a digital asset or business, Empire Flippers is the best fit. Its calculator is tailored for website valuations and is backed by live market data, making it a specialized choice for online entrepreneurs.

For users who need broad functionality fast

Calculator.net is a great resource if you need a variety of ready-to-use financial calculators without customization. It’s especially useful for educational or personal finance content hubs that link to calculators without needing to embed them.

Tips for choosing the best calculator:

- Define your primary goal — Is it user engagement, lead capture, or educational value?

- Check if embedding is supported — Not all calculators can be integrated into your website layout.

- Evaluate customization needs — Choose a builder if branding and field logic matter.

- Consider ease of setup — No-code solutions save time and require no technical background.

- Balance features with budget — Free tools are great for reference; paid ones offer advanced utility.

Ultimately, the best website calculator is the one that aligns with your specific business goals, user expectations, and technical comfort level. Use the comparison above to match each tool’s strengths with your needs.

Next, let’s look at the broader advantages of using calculators on your website and how they can improve both user experience and business results.

Why Add a Calculator to Your Website: Benefits

Once you’ve identified the right solution, embedding a calculator into your website can bring long-term value for both your visitors and your business. This section covers the key benefits of using a website calculator and why it’s a smart addition to your digital strategy.

| Benefit | Why It Matters |

|---|---|

| Boosts engagement | Calculators encourage interaction, keeping users active on your website longer and reducing bounce rates. |

| Delivers instant value | Users receive immediate answers to their questions, creating a more satisfying and efficient experience. |

| Improves decision-making | Accurate results help users evaluate costs, savings, or outcomes, supporting more confident decisions. |

| Captures leads | Integrated forms allow you to collect contact details in exchange for personalized results or quotes. |

| Reduces support workload | By answering common financial or pricing questions, calculators lower the demand on your support team. |

| Supports mobile users | Responsive calculators ensure a smooth, usable experience across all screen sizes and devices. |

| Strengthens brand credibility | Offering helpful, functional tools positions your brand as professional, trustworthy, and solution-oriented. |

Whether you run a service business, a product store, or a content platform, website calculators offer a practical way to engage users and deliver value with minimal friction.

Now, let’s address some of the most common questions people have about using and embedding website calculators.

FAQ

Can I install a calculator widget without coding?

Are website calculators mobile-friendly?

How do I update calculator content after embedding it?

Are free calculators accurate enough for business use?

Is it possible to collect user data through a calculator?

Final Thoughts

Choosing the best website calculator is about more than just embedding a widget — it’s about offering value, clarity, and functionality that supports user decision-making. Throughout this guide, we’ve explored the leading options across various use cases and highlighted Elfsight’s solution as a flexible, no-code tool suitable for businesses of all sizes.

Whether you’re focused on lead generation, financial guidance, or self-service functionality, implementing a reliable and customizable calculator can elevate your website experience significantly. Use this comparison as your roadmap to make a well-informed, strategic choice.